How Much Does It Cost to Build Fintech App In 2023?

In times gone by, financial services were limited to banks alone. But with a huge influx of fintech start-ups, hundreds of banking and financial facilities are within reach.

Fintech has transformed the financial services industry, flattered as a multi-billion-dollar sector. This technology has allowed financial organizations to offer novel and ground-breaking services to their clientele, subsequently leading to the sector’s growth. As the technology continues to go forward and with a decrease in the Fintech app development cost, the potential for more services in the Fintech sector is rather broad.

America’s fintech market stands at 4 trillion USD. This points to the significant growth of the financial services industry. So, it is the finest of time to strategize Fintech app development services for your business.

When Building a FinTech App can be Beneficial?

There is no doubt about the massive potential and popularity of FinTech apps. Fintech apps start from mobile wallet apps on smartphones to cryptocurrencies and much more. There’s a fraction of fintech in each transaction and financial activity in our lives. We can say, Fintech app development trends are on the go!

Fintech app development companies cater to customers’ digital finance and transaction needs. So, Fintech app development trends are driving an upsurge in business growth and financial transactions. Any business that fails to keep pace with this development is probably to slide down.

Every business has different market objectives; consequently, there is no criterion listed for functions and features to be dependent on. But a Fintech app development guide can assist in determining the need to create a basic or modern Fintech application. High performance and the latest features to meet the expectations of your customers are the foremost.

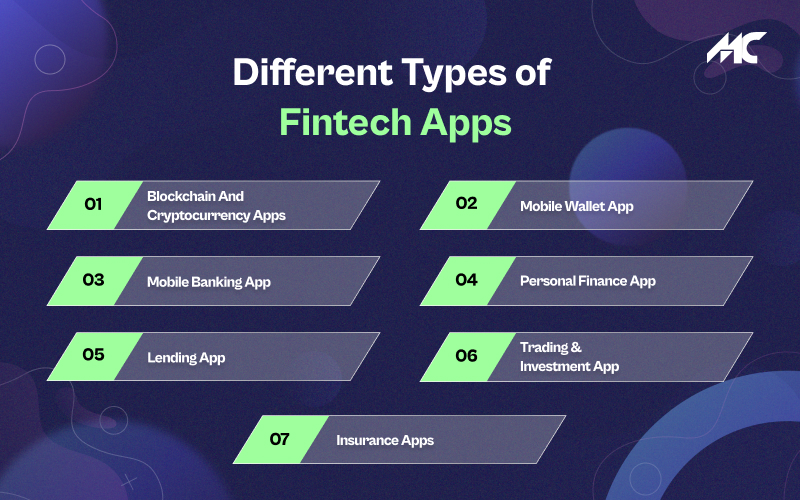

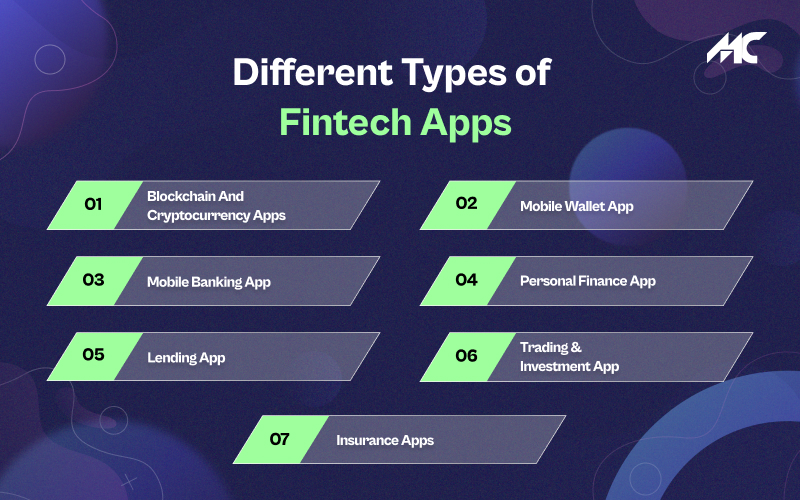

What are the Different Types of Fintech Apps?

The fintech industry has grown to accommodate numerous different types of financial requirements of people and businesses. From letting instant bank transfers to insurance claim settlements to many things, there’s a fintech app for every kind of financial need.

Blockchain and Cryptocurrency Apps

These two innovative technologies are already revolutionizing the fintech landscape. Businesses and individuals are able to achieve new opportunities for secure and decentralized transactions. It means financial activities without the intervention of governments or regulatory bodies. Blockchain technology is already popular for providing transparent and tamper-proof ledger to record transactions with complete distribution. You can also develop blockchain fintech apps that support the exchange of cryptocurrencies like Bitcoin, Ethereum, Ripple, and more.

Mobile Wallet App:

Mobile wallets let customers link their bank accounts and process payment straightaway for their purchases by just typing the mobile number of the merchant or by scanning a QR code.

Mobile Banking App:

Most banks turned their old-style online banking solutions into mobile banking apps completely. You can do all your net banking transactions, check statements, update information and request banking activities through a mobile banking app. All monetary solutions are offered online by digital or Internet banking applications. Users no longer require visiting the branch for each issue because Fintech banking apps can handle it.

Personal Finance App:

These fintech apps come with versatile capabilities of processing transactions, linking multiple bank accounts, debit and credit cards, and doing complete financial planning covering investments and expenditures of customers. Customers can manage their finances flawlessly. People may keep track of their earnings and expenses, create a budget, and confirm they stick to it. These apps work as individual journals for tracking all their financial transactions.

Lending App:

There are also separate fintech apps to pay and process loans to eligible users depending on their credit score and credibility. The P2P lending industry is expanding rapidly right now. Corporations are forging alliances to let customers apply for loans via digital channels. In spite of the significant risk, it makes the lending procedure more efficient. This industry utilizes technology to offer financial solutions via more accurate processes. Smart systems that confirm and validate individuality credentials use artificial intelligence and machine learning algorithms to generate error-free results.

Trading & Investment App:

There are numerous apps easing equity market trading and other types of financial investment. Apart from providing direct access to stock market terminals, these apps offer consultations for investment choices. These apps give the consumer a chance to invest in a variety of services. A number of firms, like mutual funds, could prefer this type of software for their users. Trading applications and cryptocurrency exchanges are some other variations of these investing solutions. Other FinTech app domains like digital wallets,e-portals, and more are flourishing as well. Apps for quick purchasing, such as Amazon Pay, are becoming a daily word. It is very important to understand that getting these apps developed can add to your overall financial plan, considering the functioning of the features like EMI calculators, real-time credit score tracking, data reporting, analytics, etc.

Insurance Apps:

Life insurance and general insurance apps are already famous amongst customers for smear the correct insurance coverage according to their needs and suitability. These apps can do all from testing eligibility for insurance requirements to subsiding insurance claims. Insurance-related Fintech businesses are at present making efforts to digitize their present services. Fintech can give more affordable coverage policies by means of apps at variable rates. The customer can access policies across several lines with an insurance app already installed. It makes communication quicker and simpler. It offers the user quicker claims dispensation, which results in prompt contract closure.

But you might wonder about the Fintech app development cost. Depending on the features and scale of your app, you can compute the cost of the development.

Must Read: How FinTech App Development Services Can Help Your Business?

Budget Required for Fintech App Development

There is no fixed Fintech app development cost. Each organization has unique requirements and objectives, which affect the pricing. The cost is influenced by a lot of factors including its kind, features, location of the Fintech app development company, functioning, and total development period.

| Basic Fintech App | $20,000 and $40,000 |

| Average Fintech App | $40,000 and $70,000 |

| Complex Fintech App | $70,000 + |

These are rough approximations that can differ greatly depending on numerous features: platform specifics, functionality, API integration, complexity, development team, hourly developer rate, interaction patterns, and more.

Product Requirements

The app requirements are the primary part that has an effect on Fintech app development costs. There are two features to app requirements which are-

Scope of work:

The collection of features that the financial application must have or the attempt essential to develop these features makes up the scope of work. The project size and number of hours necessary to finish development increase with the scope.

Level of product complexity:

Project complexity, conversely, refers to how multifaceted a software product’s idea is. Building, testing, and organizing a product is harder if its logic and idea are sophisticated. Non-functional needs are significant too. They include several traits that explain the program’s operation, for example, scalability, safety, usability, reliability, performance, etc. They are important since they have an impact on customer satisfaction.

Interactive UI/UX:

It’s worthwhile to attempt to create a financial app with an easy-to-use interface. The user experience is better by the faultless app design. An app needs to be built correctly, from deciding the suitable fonts to using easy language and white space suitably. An effectual app allows users to find the information they require fast. This is also a must if you desire your app to be a hit. So spending on an easy-to-use interface for your app can for no reason go incorrect.

What is the Cost of Maintenance?

Maintenance and safety are vital parts of the banking and financial industry. The Fintech application maintenance has to be done often so as to guarantee the safety measures offered by a Fintech app development company.

Cost Defined by Types of Apps

| Type of App | Development cost |

| Banking App | $30,000-$60,000 |

| Lending App | $20,000 to $40,000 |

| Insurance App | $40,000 and $60,000 |

| Investment App | $50,000 and $110,000 |

| Consumer Finance App | $40,000 to $200,000 |

Cost Defined by Types of Teams

Your choice of team importantly affects the Fintech app development cost. Requiring to hire Fintech app developers is essential to fill up the gaps in the team. The money spent by Fintech mobile app development company to hire Fintech app developers will be reflected in the entire app development price.

Cost Based on Location

An important characteristic that has an effect on the price is the location of the Fintech app development company. The cost is an estimate depending on the hourly rate of the development team of 4-5 experts and the duration to create an app in a specific country. A FinTech application development expert in the US typically charges more than an expert in India. If compared, we can see the cost to hire Fintech app developers in different countries does have a wide range. Fintech app development services are available even for start-ups.

Growth Story

Fintech apps are progressively determining the evolution of the entire financial industry. Even within the fintech sector, some features are already becoming out-of-date making way for novel and ground-breaking ones. The constant drive for novelties made fintech even more competitive than ever before. Fintech apps are a valuable investment, as the global market has good prospects.

Fintech is emerging and changing rapidly, and a finance app must meet market-based competition and customers’ expectations. However, it is not an easy job to determine the cost of FinTech app development services. There are many parameters to consider. Here, comes handy a Fintech app development guide, Hiring or outsourcing to a Fintech app development company can save a lot of time, money, and effort. But without a reliable partner, you can’t imagine having the best technologies, trends, and functionality for your organization. MobileCoderz would be a perfect companion for fintech app development services with expertise in different kinds of FinTech apps. An experienced team on board is helpful since they’ll offer you, their expertise. The experts have extensive training and experience in their domain to ensure they fulfill all your security and maintenance requirements.

MobileCoderz is one of the leading mobile app development companies that is driven by innovation and creativity. They offer a customized solution that can be tailored to suit your needs. They analyze your requirements and then use the latest software development methods and tools to create a product that meets all specifications. Whether it’s an app example or a full-fledged product, the team of designers helps you make something that people will feel love for using it. They have years of experience in this area and will work untiringly to make something that matches their needs. After customer support is offered for the best customer experience.

Whoever said that good-quality mobile app development services could weigh your pocket, MobileCoderz is here to prove them wrong.

Frequently Asked Questions

What is the cost to build a FinTech app?

To sum up the cost of building a FinTech app might range from $30,000 to $200,000 depending on the overall complexity of the requested app.

What is the duration to develop a FinTech app?

Building an easy FinTech app might take 3-6 months. The project’s difficulty, the requirements, and the type of FinTech application development solutions you select can impact the total necessary to make a FinTech app. It means that you have to dedicate even 12-18 months.

How to earn money with a fintech application?

The most common and important method for FinTech apps to make money for their services is showing ads within the app. Third-party advertisement networks pay app owners when users click on their advertisements. Additional bases of income may also comprise paying for subscriptions and in-app acquisitions.

How much does it cost to build a basic FinTech app?

The standard price of building a basic FinTech app with minimum features (safe sign-in, account management, easy UI/UX design, digital payments, alerts, and notifications) might vary from$20,000 and $40,000.

How much does it cost to develop an average FinTech app?

If you want to develop a fintech app with medium complexity. Then, be ready to pay somewhere between $40,000 and $70,000. Regional language choice, customer service options, personalized experience, and peer-to-peer payments will be some common features of the application.

How much does it cost to create a complex FinTech app?

Do you want to develop a complex FinTech application with some advanced features like user-first navigation, personalized UI/UX, biometric sign-in, data visualization, voice-assisted banking, and gamification? Then, be ready to pay at least $70,000.

How much does it cost to hire an outsourcing development company to develop a FinTech app?

If you want to hire fintech developers from an outsourcing development company, then be ready to invest somewhere between $30,000 to 300,000. However, there are a lot of factors that can determine the total development cost. App complexity, design, development team, features, and location are some critical factors.

-

How Much Does it Cost to Build an MVP App in 2024?

How Much Does it Cost to Build an MVP App in 2024? -

How Does E-Commerce App Development Help Retailers With Their Problems in the Retail Industry?

How Does E-Commerce App Development Help Retailers With Their Problems in the Retail Industry? -

How AI is Changing the Landscape of the Online Food Delivery Industry?

How AI is Changing the Landscape of the Online Food Delivery Industry?