Complete Guide To Fintech Mobile App Development

The FinTech sector is rising at a pace never before. FinTech, a portmanteau of Financial Technology, makes financial services fast, secure, and more accessible with the use of technology. Whether banking, budgeting, investments, or any other financial service, people can easily get them with FinTech apps.

FinTech mobile apps are designed to provide financial services at users’ convenience with better satisfaction than traditional platforms. The success of various FinTech apps has attracted many entrepreneurs to make their own apps and churn out profits.

This is possible that you are also planning to create a FinTech app that inspired you to read this blog. You are at the right place. This comprehensive fintech app development guide will provide all the information that you need to build your own FinTech application.

Whether you are a startup, an aspiring entrepreneur, or an established business, this guide will give you in-depth insights from conceptualization to development of a fintech app. This will help you make the right decision.

Let’s dive into the details.

- What is FinTech App Development?

- Let’s See the Different Types of FinTech Mobile Apps

- Examples of Fintech Mobile Apps

- Must-Have Features for FinTech Mobile App Development

- Essential Requirements for FinTech App Development

- Latest Technology for FinTech Application Development

- What’s the Process of Finance App Development?

- What are the Technologies Used for Fintech Application Development?

- How Do Fintech Mobile Apps Earn?

- How Much Will Fintech App Development Cost You?

- How MobileCoderz Can Help You?

- Frequently Asked Question

What is FinTech App Development?

Let’s begin with the basic question of what a fintech app is. A financial technology application contracted as FinTech App is a mobile application to offer financial services such as online banking, stock purchasing, investing in insurance, and more. These apps make the smart use of technology to provide financial services to businesses and individuals.

FinTech app development is the process by which you will build a mobile app to offer financial services. This process entails several phases starting with the ideation up to testing and delivery. A combination of skills, experience, and knowledge of the financial sector is required to build finance app development.

A typical fintech mobile app development process looks like this:

- Defining the goals

- App design

- Backend development

- Testing

- Deployment and maintenance

These phases could vary based on the development process followed such as Waterfall, Scrum, Agile, etc. Today, agile is considered to be the best methodology to develop mobile apps. It offers the scope for creating code in batches and reviews for client feedback.

Let’s See the Different Types of FinTech Mobile Apps

Fintech mobile app development services help you build various apps for different purposes and target audiences. There are a few types of fintech apps that are very popular and you can check them in the below section.

- Banking Apps

- Insurance Apps

- Investment & Cryptocurrency Apps

- Lending Apps

- Budgeting Apps

- Digital Wallet App

Useful for you: Digital Wallet App Development Guide

Examples of Fintech Mobile Apps

- Geico: It’s a fintech auto insurance app.

- Robinhood: A fintech trading app with nice features.

- Starling: It’s a fintech banking app to allow users open accounts for free without documents.

- QuickBooks: A very popular fintech accounting app to manage accounts and money.

Must Read: Innovative FinTech App Ideas

Must-Have Features for FinTech Mobile App Development

The features and functionalities of your mobile app determine how usable it is and whether it meets users’ expectations. This is crucial in deciding whether your app will succeed or fail. Your fintech mobile app will be handling the sensitive financial information of your customers. Hence, it is essential that your app is user-friendly and secure enough to protect customers’ data at the same time.

Let’s see the must-have features of a fintech application.

1. Registration and Authentication

A fintech app allows users to register themselves by creating a user account. Since finance mobile apps allow financial transactions and even keep their record, strong user authentication is required to identify every individual user. You can integrate user authentication features with a login form or OTP (One Time Password) based system. The app should also allow users to change their passwords securely if they forget.

2. User Account

The user account in a fintech mobile app provides various features such as accessing services, tracking transactions, and managing personal settings. Users can access all the fintech app features that are specifically available to them.

3. Adding Bank Cards

Since a fintech app provides an easy way for online transactions, the users should be able to add their bank cards to make this happen. The users should be able to add credit or debit cards, manage those cards, and access their account information.

4. Push Notifications

Push notifications and alerts are useful to deliver necessary messages and updates to app users. Your fintech app can use notifications to notify users about deals, promotions, account updates, and so on. Notifications ensure user engagement by providing regular alerts and messages.

5. Payment Gateway

There should be a way to send and receive money or make online transactions. A payment gateway is added to fintech app development to provide the feature.

6. Language Options

A fintech app can have lots of features and they might be customized according to specific business requirements.

Essential Requirements for FinTech App Development

A fintech application can have multiple features. No matter what features you wish to integrate into your fintech app, there are a few essential requirements for these apps. These are the requirements that you must consider for fintech app development to make it as per the industry standards.

1. Usability

The usability of your fintech app is beyond UI/UX. It covers various aspects like compatibility with different devices, easy navigation, accessibility, and optimized layout. So, when you create the UI/UX of fintech, these are the key requirements to fulfil in app design.

2. Security

Developing a fintech mobile app comes with a great responsibility of protecting your users’ data. The app users need assurance before they build confidence in using your fintech mobile app. You must adopt modern technologies and security methods to make sure that your app is hack-proof. Two-factor authentication, encryption, and secure servers are a few ways to build a highly secure app.

3. Credible APIs

APIs are an integral part of fintech applications. Your app can use multiple APIs to connect with different systems and apps. These APIs help to extend the functionality of your mobile app. Choose third-party APIs that adhere to security standards and offer data protection. Security protocols with such APIs will provide an extra layer of security to your application.

4. Legal Compliances

When dealing with financial services, your mobile app requires you to obey some guidelines and legal compliances. You are required to adhere to these compliances when it comes to financing app development. The main compliance is PCI DSS (Payment Card Industry Data Security Standard). Other compliances are GDPR, CCPA, PIA, etc.

Latest Technology for FinTech Application Development

FinTech apps are becoming smarter and safer with technological advancements. There are many new advanced technologies available today that you can use to make an app that is above user expectations. Before you develop your app it’s crucial to check the latest fintech app development trends to create a state-of-the-art app for your business. Let’s check the latest technologies below.

1. Chatbot

The use of chatbots is increasing in fintech applications. Chatbots help fintech businesses provide better customer services and lower costs by automating customer support. App users can easily get quick support for their problems with chatbots and get other information.

2. AI

AI or Artificial Intelligence is also useful for fintech app development as it provides benefits like automation and personalization. AI can automate data processing and help in personalizing the app.

3. Blockchain

Blockchain is a hot new technology that has multiple use cases. This is a very secure distributed database. It is a chain of blocks of data which immutable and accessible to multiple users. Blockchain development services are used to develop new-age apps like digital wallets, dapps, NFT, and more.

4. Biometrics

Accessing a user account with a user id and password is not quite a safe method. Therefore, now with the use of technology, fintech app users can access their accounts through biometric credentials like fingerprint and face recognition.

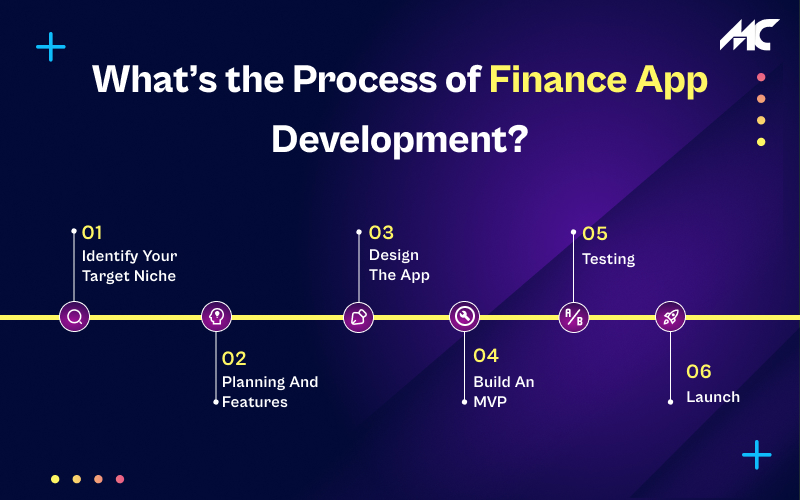

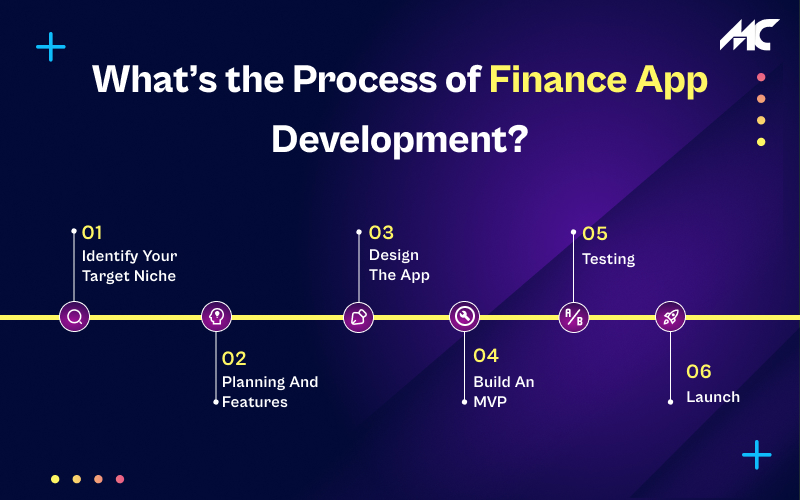

What’s the Process of Finance App Development?

Now let’s see how to create a fintech app. There are numerous phases in developing a fintech application. This process requires immense technical experience and expertise that you can have with a fintech app development company. The company can build a perfect fintech app for your business based on your requirements and expectations. The following are all the phases of fintech application development.

- Identify your target niche

- Planning and features

- Design the app

- Build an MVP

- Testing

- Launch

1. Identify your target niche

The first stage of a fintech app development is to identify your target market. Hence, start by deciding which target niche you are making an app for. There are different types of FinTech apps that are used by distinct target audiences.

You can build the right app when you understand your target niche well. It will help you create the best UI/UX that meets the expectations of your target audience and integrate the features they will appreciate. Focus on developing a complex solution that can provide you an edge over competitors.

2. Planning and features

The next one is the planning phase where brainstorming happens and a concept is built. You need to consider legalities to make sure that your fintech app meets the security and privacy compliances like KYC, CCPA, GDPR, and more. The laws of privacy depend on the region where your target audience is present. For example, apart from the US federal laws, you have to follow individual state laws.

Another thing to consider for fintech app development is the features. What features your app must have depends on its type and the requirements of your audience. Plan out all the features of your app considering the requirements of your audience.

Some features you might want in your app are:

- Fingerprint of facial login

- Chatbot

- QR-code scanner

- Offers and cashback deals

- Digital payments

- Tracking of finances

3. Design the app

How do you keep your users engaged in your app? UI/UX plays a crucial role in making your fintech mobile app engaging and good at browsing. At this stage of fintech application development, it is decided whether elements will appear on the screen and what would the flow of user navigation.

UI (User Interface) is formed by the buttons, toggles, screens, icons, and other elements that appear on the screen. UX (User Experience) defines the user journey in the app. It means UX defines what users will go through when interacting with the app. UX is based on data, results, and research rather than personal opinion or choices.

App designing is not a simple process, it’s a collection of numerous subprocesses.

The process goes as follows:

- Competitor analysis: Identify the competitors and find out their strategies.

- User persona: It provides insights to build a usable and attractive app UX.

- Wireframe: Shows user flow through a design and helps to validate app design.

- App design: The UI/UX is created based on the decided pattern.

- Testing: The app design is tested to ensure that everything works as expected.

After designing the fintech app is coded and the backend functionality is added.

4. Build an MVP

How do you know that you will be successful or fail? Testing your fintech application internally can give you some idea as the employees in your company can give useful feedback. But this is insufficient to reach a good conclusion. The best way to test the app is to release it. Yes, you can release the app but not the full version but a simple one for your fintech app.

MVP or Minimum Viable Product is an app that offers basic functionality. You can choose MVP development services to launch a basic app to test the idea. The MVP can help you validate your app idea and check the responses of your target audience. If it goes successfully, you are all set to launch a full-fledged fintech application.

5. Testing

Testing here means quality assurance. You can’t launch your app right after development, it needs to be tested to make sure it is as functional as you expect. After fintech mobile app development, testing is the next phase you will follow to make sure that the app is functioning flawlessly.

There are different tests that need to be performed as follows.

- Usability testing

- Performance testing

- Compatibility testing

- Security testing

- Functional testing

There are many other tests performed on an app.

6. Launch

Launching your fintech mobile app requires a perfect strategy. Your app can be available for Android users or iOS users or both. The app needs to be published on Play Store and App Store to allow users to download and install the app. However, you also need to do marketing efforts to show your app to the target audience. Ads and other types of marketing strategies can be helpful.

What are the Technologies Used for Fintech Application Development?

There are lots of technologies developing mobile and they vary based on the type of app you want to build. You can choose Android app development or iOS development, or a cross-platform solution.

For Native Apps

Android

- Programming languages: Kotlin and Java.

- Databases: MySQL, SQLite, MongoDB, PostgreSQL.

- Payment Gateways: Stripe, PayPal.

iOS

- Programming languages: Swift.

- Databases: MySQL, SQLite, MongoDB, PostgreSQL.

- Payment Gateways: Stripe, PayPal.

For Cross-platform Apps

- Flutter

- Ionic

- Xamarin

- React Native

- Appcelerator Titanium

Hybrid Mobile Apps

- HTML

- JavaScript

How Do Fintech Mobile Apps Earn?

It is interesting to know how a fintech app works and earns. Once you launch a fintech application, you would like to monetize it. But what are the different options you have for monetization? This section will provide information on that. The following are the monetization methods that fintech apps use.

- Freemium: Your app can be free but to some extent. The app can restrict some services or features until they upgrade to the paid version.

- Transaction Fees: Your fintech app also earns by charging on transactions for payments, investments, foreign exchange, etc.

- Subscription: Instead of providing services for free, your app can charge a subscription on a monthly or yearly basis.

- Advertising: The app can also earn through targeted display ads.

How Much Will Fintech App Development Cost You?

Now comes the most crucial question – how much does it cost to build a fintech app? There isn’t a straightforward answer because it is difficult until you define your requirements and other things. The cost of developing a fintech mobile app typically depends on its type, complexity, features, requirements, and some other factors.

However, the average cost of fintech app development can be in the range of $50,000 to $350,000. The maximum can increase with more requirements and complexity. The cost also depends on the mobile app development services, you choose for your project.

For example, the cost will be higher if you choose a developer in the USA, Australia, or Europe. On the hand, the cost will be lower if you hire mobile app developer from Asia like India.

How MobileCoderz Can Help You?

We are one of the most trusted mobile app development companies in India and provide cutting-edge solutions. Our developers are proficient in the latest mobile app technologies with a lot of experience. We have developed fintech apps for many clients to date. There are many ways how our fintech app development services can help you.

Our team of mobile app developers, designers, and QA engineers, is experienced and knowledgeable. We can build a fintech app as per your aspiration no matter how complex it is. Our team has worked on many apps and come out with innovative solutions to complex problems. We have developed many fintech apps and Fniku is an example of these apps.

Frequently Asked Question

How to develop fintech apps?

There are different stages in developing a fintech mobile app which is planning, designing, developing, testing, and launching.

What does fintech app development depend on?

Finance app development depends on many factors such the complexity, requirements, features, target niche, and more.

How long will it take to develop a fintech app?

The time taken in fintech app development varies based on the complexity and requirements. You can contact us to know the precise timeframe.

How much does it cost to build a fintech app?

Fintech application development cost can be in the range of $50,000 – $500,000 which may vary based on complexity, features, development team, and other factors.

-

How Does E-Commerce App Development Help Retailers With Their Problems in the Retail Industry?

How Does E-Commerce App Development Help Retailers With Their Problems in the Retail Industry? -

How AI is Changing the Landscape of the Online Food Delivery Industry?

How AI is Changing the Landscape of the Online Food Delivery Industry? -

What Are the Costs of Developing a Healthcare App Similar to Patient Access?

What Are the Costs of Developing a Healthcare App Similar to Patient Access?