How to Build a P2P Payment App: The Complete Guide

Did you know that people sent almost half a trillion USD with the Zelle app in 2021? P2P payment apps have gained massive popularity in recent years. The growing cashless economy and the rise of the smartphone market are the direct contributing factors to this massive growth of P2P payment applications. Thus, effective P2P payment app development has enabled people to send money and pay for purchases within a couple of taps.

Global players like PayPal and Venmo are changing the way of traditional financial activities. In fact, peer to peer payment applications are completely changing the FinTech landscape. In this guide, we are going to learn everything about P2P payment apps and how to build your own app.

What are P2P Payment Apps?

Peer-to-Peer payment applications is remittance or money transfer apps. They function as the middleware to support the successful transfer of funds between users. A P2P payment application has to be connected with a credit card, bank account, or debit card for smooth transfers. Many businesses are considering developing their own peer to peer payment applications. As a result, they are heavily investing in P2P payment app development to create innovative solutions for money transfer.

These peer-to-peer applications rely on modern technologies to provide faster transactions that depend on banking regulations and transfer standards. Furthermore, the ease of use and convenience has made P2P payment apps gain massive popularity.

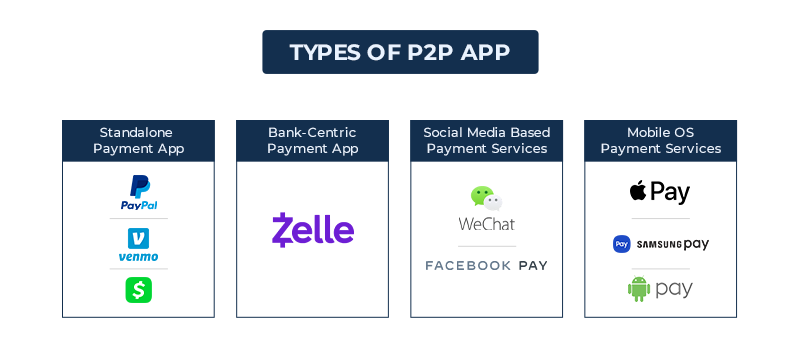

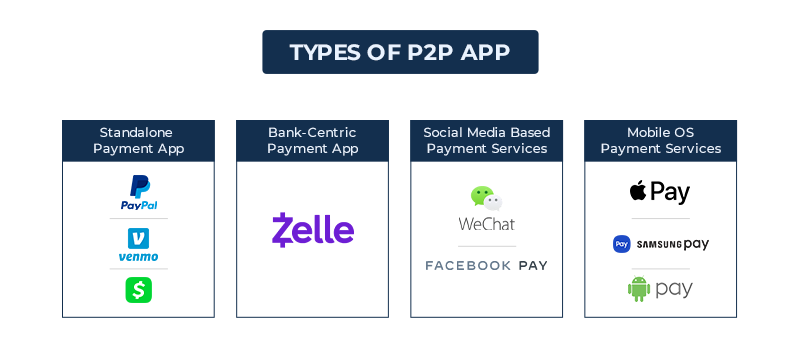

Let’s Learn a bit About the Four Types of P2P Payment Apps

If you are going to start your own P2P payment application development, then you must understand the industry of peer to peer payment applications. Above all, there are Four prominent types of P2P payment applications.

1. Bank-Centric Apps

Modern banks heavily invest in P2P payment app development to develop their own dedicated mobile payment apps or infrastructure. Furthermore, these apps are usually meant to work within a particular point-of-sale (PoS). People use these apps to withdraw or deposit money directly from their bank accounts. You can develop your own bank-centric app with the help of the right mobile app development company that ensures the best P2P payment app development process.

2. Standalone Apps

These P2P payment apps are known for facilitating online and in-person payment transfers. The users can connect their bank accounts to enjoy the features of eWallets. In fact, it makes it really convenient for users to store or send their money. Furthermore, these standalone apps usually don’t have any support from any banks. People from developing countries like India and Brazil enjoy the incredible benefits of the non-banking model. A leading mobile app development company can help you with the P2P payment app development process of building a standalone app.

3. Mobile-OS Based Apps

These peer to peer payment applications are limited to dedicated operating systems and ecosystems. For example, both Apple and Google have their own P2P payment apps that enable money transfer only within their ecosystems. These apps work with tokenization and biometric security measures to provide a very safe and reliable payment and fund transfer solution. You will need to get the best developers for smooth P2P payment app development to build a mobile-OS based app.

4, Messaging or Social Media Apps

These P2P payment applications greatly simplify the remittance process by removing the friction from the process. People don’t have to spend a lot of time on the stringent authentication process on these apps to initiate a transaction. WhatsApp has already launched its texting-based money transfer services in India. Ultimately, these apps take the convenience factor to the next level with a much simpler transaction and authentication process.

Important Features to Include in Your P2P Mobile Payment App

Before you get started with the P2P payment app development process, you must learn about the core features that you must add to your P2P mobile payment app;

1.Two-Factor Authentication

Security is a big concern in the P2P payment app development process. Thus, it becomes super important to eliminate the possibilities of unauthorized access that can compromise sensitive data and result in other risks. Accordingly, you should implement a Multi-factor authentication process as an added security layer in your P2P payment application. This can drastically reduce the chances of unauthorized access to the application.

2.Sending/Requesting Money

This is the core function of a P2P payment application that enables money transfer. Your developed solution must enable smooth money transfer with speed, safety, and simplicity. Moreover, the users should be able to send or request money from/to other users. A trusted mobile app development company can ensure effective P2P payment app development.

3.User Wallet

This feature will provide users with a central funds management system. Thus, the users will be able to keep an eye on their user accounts and bank cards. Your P2P payment application can be capable enough to scan bank cards to instantly add them to accounts. User wallets are the most critical component of P2P payment apps.

4.Transaction History

The users of your P2P payment application should be able to view the details of all incoming and outgoing payments. The users should be allowed to find relevant data from the specific transfer that have been made before. Above all, this would help the users to make better informed financial decisions.

5.Push Notifications and In-App Messages

Informing the users instantly about the transfers is important because it helps them to make better decisions. This helps them to know about the latest updates related to their account and transfers. Moreover, you can also implement this feature during the P2P payment app development process for marketing purposes.

6.User Account Settings

Give complete control of the account to your users for better convenience and trust. Furthermore, they should be able to determine their preferred money transfer method and monitor personal data management.

7.P2P Messaging

Although this is not a core functionality of peer to peer payment applications, it can provide a communication channel to build trust among the users. Furthermore, the users will be able to send specific information while making transactions on the P2P payment application. They can just communicate with each other without relying on a third-party messaging app.

8.Easy Sync with Contacts

This easy sync feature could also become a marketing tool to let people know about your money transfer services. The users of your P2P payment application will be able to see who is already using the app to send money right away.

The P2P payment app development is a critical process to include these important features into your P2P payment application. Thus, you have to be very precise and descriptive before you start the development process.

Steps to Develop a P2P Payment App

Strategizing and Research

Before you start the P2P payment app development process, you must define a business strategy and research the market.

1. Strategizing Your Business Model

To make your digital product successful, you have to understand the target audience, their unique needs, and the possibilities of using your services. You must know how will your P2P payment application help the end-users. To get started, you can try to answer these questions to understand the potential of your P2P payment app.

-

Who exactly will be using your app?

You must know the exact user demographic characteristics with an in-depth analysis of the target market. As a result, you will be able to customize the end product accordingly.

-

When your users will try to use your product?

You should know about the situations when people will have the urge to use your P2P payment application.

-

How will you earn from your P2P payment application?

Before you dive into the P2P payment app development process, you must figure out monetization options.

2. Researching the Regulations

You might come up with the most innovative ideas for peer-to-peer applications. However, it becomes important to understand the feasibility of your solutions because you have to rely on regulations. For example; cross-border money transfer places the significant challenges of different regulations depending on the geographical locations. Thus, it would be best, if you start complying with the regulations of the USA. Plus, you also have to make sure your partners are able to work with PCI DSS.

3. Build Crucial Partnerships

You have to build crucial partnerships with global names for your P2P payment application. It is not possible to develop an app like Venmo and Zelle. if you don’t secure partnerships with credible financial institutions. In fact, every successful partnership will help you secure the core payment features.

4. Choose a Mobile App Development Company

In the age of cut-throat competition, it is not feasible to build a P2P payment application on your own. Thus, hiring a top-rated mobile app development company makes sense to beat the competition with an innovative P2P payment application.

The team required for building peer to peer payment applications:

- Full-stack developers to build the server-side of the app

- UI/UX designers

- Mobile app developers for building the app

- QA analysts to maintain the quality

- Project manager to manage the entire project

MobileCoderz can help you with the best P2P payment app development services to build industry-leading peer to peer payment applications. Our client-centric development process will give you complete ownership of your project and provide you with cost-effective services.

Designing the Architecture

Now that you are done with the strategizing and research part, you have to work on defining the architecture and user experience of your P2P payment application.

– Defining the Architecture

Defining the architecture actually means identifying the building blocks of your P2P payment application and choosing the right tech stack for the job. Only dedicated developers from a top-rated mobile app development company can help you with the decision. Above all, this process is just like building the foundation of a brick castle. However, instead of building materials, you have to select programming languages, APIs, databases, frameworks, cloud services, etc.

The objectives that will be fulfilled by the architecture;

- Your P2P payment application should be scalable

- The P2P payment application could provide the best security standards

- The P2P payment app should be able to integrate with other financial services

The fundamental building blocks for the P2P payment app architecture:

- P2P payment protocol

- Databases

- Risk assessment module

- A logging instance

- Multiple API integrations

- Authentication service

- Mobile user front ends

– Preparing the Developers

After determining the technical architecture of your P2P payment application, you have to debrief your vision to the developers. You will need to have the right team that follows a collaborative process.

Determining the Nature of the P2P Payment App

You have to determine the nature of your app depending on your specific requirements. These are three types of apps;

a. Native Apps

These apps are built for a dedicated mobile operating system to provide a better user experience. However, it takes more time and resources to build native apps.

b. Web Apps

These apps are hosted on the server and can be easily accessed through the internet on almost any platform. However, there could be limited functionalities.

c. Hybrid Apps

These apps are built with a native design, but they are not limited to a single operating system. Thus, the developers can use the same codebase for building an app for multiple platforms.

Crafting the App’s UI/UX

After defining the technical architecture of your P2P payment application, you have to design an interactive graphical part.

– Prototyping

You can understand and determine the design of your P2P payment application when you have a visual concept. Accordingly, the UX/UI experts can help you visualize your concept and tailor it according to your audience’s tastes and preferences. Prototypes help you gather useful feedback from the test users. Furthermore, it also enables you to achieve the ideal ease of use. After confirming the wireframes and prototypes, we will move to the next stage of P2P payment app development.

The Development Process

After completing the designing process, we will start the development of the P2P payment application. This process will take full advantage of the developers in integrating the design and backend of the app.

– Developing an MVP

To get a fair idea about the final peer-to-peer app, you should create a Minimum Viable Product. This product will feature the basic functionalities without making you spend enormously on P2P payment app development. Plus, you will also get the chance to test the early version of the product and improve its experience. Developers will finalize the MVP once the solutions look ideal and flawless.

– Core Development

This process is all about packing the final product for release. The developers have to take the best measures in the P2P payment app development process to remove the chances of an inferior experience. After the development, the final product will be ready for testing.

Testing the Peer to Peer Payment Applications

The QA process is also a very important process to ensure the quality and performance of the P2P payment application. A top-rated mobile app development company will deploy both manual and automated testing procedures to remove bugs, glitches, errors, etc. There should be multiple test cases to filter the P2P payment application and ensure maximum security. Furthermore, you can also build a user group to best test your app and the payment gateway.

P2P Payment App Development Cost

The total cost of P2P payment app development depends on a variety of factors. Thus, it is hard to give a fair estimate cost of developing peer to peer payment applications. Still, it might cost somewhere between $60k to $80K for a functional MVP and around $160K to $200K for a final P2P payment application. Below are some of the factors that may determine the P2P payment app development cost;

- Development team size

- Technology stack

- Chosen mobile platforms

- UI/UX Design

- List of features

- API integration

Why Choose MobileCoderz for P2P Payment App Development?

Peer to peer payment applications is surely changing the ways of national and international payments. In fact, more and more people are migrating from traditional banking services to innovative peer-to-peer applications for fund transfer. MobileCoderz is a Best mobile app development company that provides cutting-edge P2P payment app development services for businesses looking for growth and market opportunities. We always take a client-centric approach in our P2P payment app development services.

-

A Complete Flutter App Development Guide: The What, Why, and When

A Complete Flutter App Development Guide: The What, Why, and When -

Complete Guide To Fintech Mobile App Development

Complete Guide To Fintech Mobile App Development -

SaaS Application Development: benefits & challenges for startups

SaaS Application Development: benefits & challenges for startups