Top 8 Innovative FinTech App Ideas for Startups in 2023

The global fintech market is expected to increase exponentially with a worth $ 309.98 Bn by 2023.

The number will increase with every passing year and skyrocketing the speed of digitization in financial services.

Today digital companies are embracing the innovations by leveraging state-of-the-art technologies to stay ahead in this fierce competitive market.

They look for innovative ways to develop secure and digitized financial processes to their global clientele.

Do you want to be gamechanger in the fintech industry? Or you are looking for some out-of-the-box ideas to entice your potential investors for your startup?

Need not to worry. We can help you in that.

This article will help you craft innovative and revenue-generating fintech app ideas that make your FinTech startup thrive.

Brief Introduction to Fintech

Fintech or financial technology is the combination of finance and digital technologies. In fact, it is a type of digital solution that enables banks and financial institutions to provide multiple types of financial services. Furthermore, Fintech generally uses web, artificial intelligence, blockchain, machine learning, cloud computing, big data, mobile app development, and other technologies to craft the fintech solutions.

Why is the demand for Fintech apps growing in the market?

Fintech apps are either web or mobile applications that offer multiple types of services. These apps can provide banking services, stocks & trading, investment, and much more. Fintech apps solve consumers’ problems and help industries save costs. Lastly, businesses now look for the fintech app development company to build fintech mobile applications that streamline their existing ecosystem.

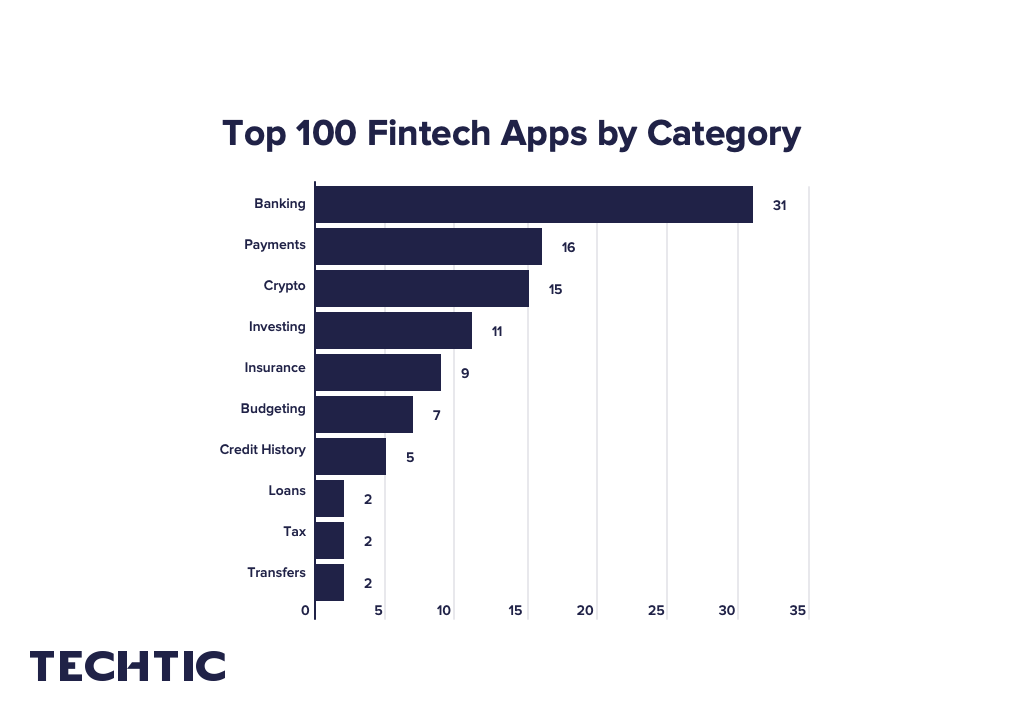

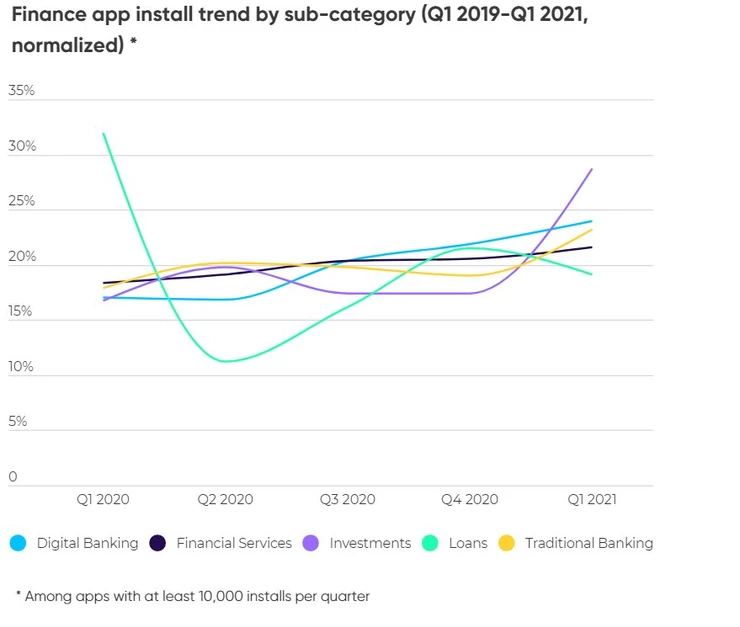

As per the latest report released from Appsflyer, there has been a 132% growth in downloads of the fintech app category on app stores. In fact, the growth in the usage of Fintech apps took a faster face after the Covid-19 pandemic hit.

(Source:Finopotamus.com )

The Appflyer’s report revealed that fintech marketers invested $3 billion in user acquisition in 2020. In fact, you would be surprised to know that the global fintech market is estimated to reach $25.6 trillion with a CAGR of 6% in 2022.

Top fintech apps with their total market valuation in 2022

| S.N. | Fintech App | Total Valuation | Country |

| 1 | Robinhood | $32 Billion | USA |

| 2 | Chime | $25 Billion | USA |

| 3 | Nubank | $30 Billion | Brazil |

| 4 | Mint | $103 Million | USA |

| 5 | Revolut | $33 Billion | UK |

| 6 | Coinbase | $85.7 Billion | USA |

| 7 | N26 | $3.5 Billion | Germany |

| 8 | Finch | $15 Million | USA |

| 9 | Tellus | $265 Million | USA |

| 10 | MoneyLion | $2.9 Billion | USA |

Therefore, the demand for fintech app development has increased dramatically in the past few years. And this increase in the demand for fintech solutions is because of its growing usability across banks and the financial sector.

Banks are now using mobile banking apps to offer their banking services ceaselessly to their customers. Moreover, enterprise and insurance companies are developing fintech mobile applications to streamline their financial services. As a result, the growth in fintech app development is taking a fast pace.

The demand for fintech apps is enhancing because it solve various persisting problems in the current financial and banking ecosystem with the following features:

- Reduce development & maintenance costs

- Broad customer reach

- Enhanced functionality and usability

- Better customer engagement

- More sales opportunities

- Improved customer experience

- Great security

- Quick accessibility

- Easier data management

- Highly convenient

We hope you have now realized how profitable developing a fintech app is. With that said, let’s know

Top 8 Innovative FinTech App Ideas For Startup in 2023

1. Digital Banking Mobile App

The banking industry is passing through digital transformation. In fact, banks are now preferring digital banking solutions like mobile banking apps, and internet banking apps to conventional banking practices. Therefore, these apps assist banks to streamline their banking services.

Especially mobile banking apps are proving to be a boon. Previously in the age of web development, banks were taking advantage of internet banking. But with the disruption of fintech app development, banks are getting better digital solutions.

Banks are developing dedicated and separate mobile banking apps to provide 24×7 services to their customers. Hence, developing an effective digital banking app could prove to be a successful fintech app startup idea.

Startups can work with banks to provide them with advanced and high-performing digital banking mobile applications. As a result, they can create a B2B common marketing platform for all banks to connect with global customers or other offerings.

Data that proves the demand for digital banking apps

- Around 65% of people in the USA use digital banking.

- More than 60% of bank customers prefer digital banking methods.

Why this fintech app will work

- Streamline banking service

- Create marketing opportunities for banks

- Provide a virtual banking solution to customers

- B2B platform for banks

Examples of digital banking apps

- Ally mobile app

- Betterment mobile app

- Capital One mobile app

- Chase mobile app

2. Insurance Mobile Apps

Insurance sector is a major segment of the fintech market. Today, insurance companies are now adopting digital solutions to reach more customers. In fact, they use insurance mobile applications to offer their insurance policies, sell new products, or provide online customer support round the clock.

Customers also prefer using insurance mobile apps. It is because they feel tedious to browse websites for existing information. Thus, with insurance mobile apps, customers can explore and compare different insurance policies.

They can easily claim requests and look at other products & offerings. Therefore, insurance mobile apps are emerging as a hot fintech app development concept for fintech startups in 2022.

Data that proves the demand for insurance mobile apps

- As per the Grand View Research market report, the global Insurtech (insurance technology) market is expected to reach $3.85 billion with a massive CAGR of 51.7% for the period 2022-2030. Hence, startups can develop the app with long-tern business vision.

- The health & medical insurance industry in the US was valued at around $ trillion in 2020. And this is projected to increase more.

Why this fintech app idea will work

- Automates claiming process

- Open more sales opportunities

- Increase revenue

- Cater to young generation investors

- Personalized offers

- Great digital customer experience

Examples of insurance mobile apps

- The General Auto Insurance

- Allstate Mobile

- GEICO Mobile

- Esurance Mobile

- American Family Insurance

3. P2P Payment Apps

The demand for P2P (peer-to-peer) payment solutions has increased significantly in the current market. Businesses are looking for more P2P payment apps due to its great benefits. Above all, P2P payment apps allow parties to directly transfer money from one person to another without passing through a middleman.

This not only helps businesses transfer money quickly and safely but also save cost in transaction fees. As a result, this fintech app is gradually becoming a reliable and cost-saving method for fund transfers. Thus, Fintech app development company gets a high number of requests for developing P2P payment web and mobile applications.

If you are a Fintech startup, you can develop high-performing and secured P2P payment mobile apps for businesses. As a matter of fact, you can also create P2P payment apps using blockchain technology for cryptocurrency exchange.

At present, companies are looking for advanced blockchain-based apps for crypto exchange. Hence, fintech startups can also invest in blockchain development services to build such fintech solutions.

Data that proves the demand for P2P payment apps

- As per the MarketWatch report, the Global P2P payment market is estimated to exceed 1927.23 million by 2030 from 5491.60 million in 2020 with a CAGR of 12.10%. Thus, its market scope is bright.

- In the USA alone, the number of mobile P2P payment app users is projected to reach 56 million figures. And therefore, developing an app for US audience can be a profitable idea.

Why this fintech app idea will work

- Ease of use and convenience

- Extremely low transaction fees

- Lower currency conversion rates

- High security

- P2P payment apps offer anonymity

- Minimize the risk of data breaches

Examples of P2P payment apps

- Zelle

- Venmo

- Cash App

- Paypal

- Google Pay

- Apple Pay Cash

4. Mobile Crowdfunding Apps

A Crowdfunding app is a digital platform where people can raise funds for a campaign or a cause. Furthermore, crowdfunding is among the most common activities in the industry. From businesses to non-profit organizations, every entity needs a reliable and robust platform that helps them in raising money through crowdfunding.

Especially during the Covid-19 pandemic, the Crowdfunding sector witnessed a huge jump in its growth. And today, the demand for Crowdfunding mobile Apps is taking a new pace.

Hence, fintech startups here can take advantage of this emerging opportunity. Since most Crowdfunding platforms serve web users, you can build mobile Crowdfunding Applications. This fintech app idea is profitable because people mostly use mobile apps for social activities. They can easily donate or transfer their money through a Crowdfunding mobile application securely and easily. As a result, this idea could prove to be a successful fintech app development concept.

Data that proves the demand for crowdfunding mobile apps

- As per Statista, the global Crowdfunding market was valued at $12.27 Billion in 2021. Which is now projected to double by 2027 with a CAGR of 11%. Hence, it shows good signs of business scope for the future.

- Market report suggests that there will be 12,063,870 crowdfunding campaigns happening by 2023. Therefore, businesses will need more Crowdfunding applications.

Why this fintech app idea will work

- Fast and secure way to raise funds

- Mobile users are higher than web users

- Social campaigns work better on mobile platforms

Examples of crowdfunding mobile apps

- AppStori

- Kickstarter

- AppsFunder

- Indiegogo

5. Cryptocurrency Exchange Mobile App

Due to the increased use of Cryptocurrency, people now look for the easiest and most convenient ways for Cryptocurrency exchange. At present Cryptocurrency is being used across industries for various purposes.

This usage has pushed the need for a fast and reliable platform for Cryptocurrency exchange. And Cryptocurrency exchange has also become legal in most counties. Thus, you don’t need to worry about compliances or regulations.

As a Fintech startup, developing a Cryptocurrency exchange mobile app could be a promising business model. As the owner of the Cryptocurrency exchanges mobile app, you can earn commission from the transactions taking place within your app. Therefore, investing in this fintech app concept can help you set up your own venture in cryptocurrency market.

Data that proves the demand for cryptocurrency exchange mobile app

- Around 70 million people use blockchain wallets globally. Hence, its future is green.

- As per the Grand View Research market report, the Cryptocurrency Exchange market size is projected to rise from $1.6 Billion in 2021 to $2.2 Billion by 2026 with a CAGR of 7.1%. Therefore, cryptocurrency exchange app development will become a new trend in the upcoming time.

- The number of Cryptocurrency app users is expected to exceed 60 million in the USA itself.

Why this fintech app idea will work

- 24×7 Cryptocurrency Exchange

- fast and secure Crypto trading

- No need for desktop or web platform browsing

- Increase user base quickly

Examples of cryptocurrency exchange mobile apps

- Coinbase

- Binance

- FTX

- Cash App

- eToro

- Robinhood

- Revolut

6. Personal Finance Apps

Personal finance applications allow people to manage their personal financial things. This is a type of fintech mobile app for providing personal financial management features to people. These apps allow users to monitor their expenditure, saving, and investments. People can also track their bill payments and improve their credit scores. Hence, the demand for useful personal finance apps is growing consistently.

At present, consumers are looking for feature-rich and meaningful Personal Finance Apps that help in personal finance management. They use these apps to make intelligent investment decisions. Therefore, Fintech startups can come up with unique and useful Personal Finance Apps.

Data that proves the demand for personal finance apps

- As per Allied Market Research, the personal finance app market is estimated to reach $1,576.86 Billion by 2027 with a CAGR of 5.7% between 2020-2027. Therefore, it gives assurance to startups who are worried of its future reliability.

Why this fintech app will work

- Organize Your Finances Efficiently

- User-Friendly Interface

- Make the right financial decision

- Help people Meet their Financial Goals

Examples of personal finance apps

- Mint

- You Need a Budget

- Personal Capital

- Prism

- Spendee

- EveryDollar

7. Mobile Wallet App

At present, consumers mostly use their smartphones and mobile devices for online commercial activities. Whether it is online shopping or crypto exchange, mobile apps provide a faster and more convenient way to perform all types of online commercial activity. And therefore, the use of mobile wallets is increasing significantly.

Mobile wallet apps provide a wide range of features for performing multiple financial activities. Through mobile wallet apps, people can store their finance and investment documents, bank docs, and exchange cryptocurrency as well.

Fintech startups here can develop an innovative mobile wallet app that provides amazing features for managing various financial and commercial activities. Thus, developing a mobile wallet app is emerging as a profitable fintech app concept for businesses,

Data that proves the demand for digital banking apps

As per the MarketWatch report, the global mobile wallet app market size is projected to surpass $ 142700 million with a CAGR of 12.0% by 2028. Hence, startups can look for investment opportunities in long-term scale.

Why this fintech app idea will work

- Prevent fraud

- Save time and effort

- Secure online shopping

- Make loyal customers

- Wide range of uses

Examples of mobile wallet apps

- Google Pay

- Apple Pay

- Alipay

- Venmo

- Square Cash

8. Investment App

Investment mobile app guides people to invest in stocks, trading, and policies. These apps help people make the right decisions as to where to buy, deposit or invest. Today, the number of Investment Apps is growing tremendously in the market. Robinhood is one of the top-grossing mobile apps in the USA that provide investment-related services and information to users.

This app has been valued at $32 Billion in 2021. Not only this app, but other investment apps like Chime, Nubank, Mint, Revolut, and Coinbase have been valued at more than $30 Billion in USA.

Thus, you can conclude from this figure how profitable this fintech app is. Despite the growing competition in investment apps, the demand for more investment apps continues to increase. Therefore, startups can take advantage of this app idea for earning big revenues like famous apps.

Data that proves the demand for cryptocurrency exchange mobile app

As per the Business of Apps report, the number of stock trading app users will exceed 92 million by 2022. Hence, you will have a wide range of audience despite growing competition.

Why this fintech app idea will work

- Help Investment Beginners

- Educate people in stocks and trading

- Provide reliable and instant investment information

- Offer faster and easier method of investment

Examples of investment apps

- Betterment

- Invstr

- Acorns

- Wealthbase

- Robinhood

Why Partner with MobileCoderz for Fintech App Development?

MobileCoderz is the top mobile app development company that holds a proven track record of delivering successful fintech mobile apps for global businesses. We hold great excellence in developing multiple types of fintech mobile apps for fintech startups and mid-size finance companies.

We follow up-to-date coding and mobile app development practices. Therefore, our solutions have enabled our various international clients to succeed in the competitive fintech industry, especially in the USA. You can even hire blockchain developers for your enterprise-scale fintech application.

To Wrap Up

We hope you are now quite familiar with the top innovative fintech app ideas. These fintech apps are evolving impressively and continuously broadening the business scope for upcoming startups.

However, having the best idea is not enough. You need the right expertise and intelligence to transform your innovative fintech app idea into a full-fledged mobile application. Therefore, you should find a professional fintech app development company that can assist you to build high-standard fintech apps. And this is where MobileCoderz comes in.

If you have an innovative fintech app concept in your mind, let’s give it a real shape together.

Book a Free Consultation and Speak with Our Fintech Experts

-

Mobilecoderz Awarded as India’s Best iPhone App Development Company by Clutch

Mobilecoderz Awarded as India’s Best iPhone App Development Company by Clutch -

How Much Does It Cost to Develop a SaaS Application?

How Much Does It Cost to Develop a SaaS Application? -

Mobilecoderz recognized as the Top App Development Company in Saudi Arabia by GoodFirms

Mobilecoderz recognized as the Top App Development Company in Saudi Arabia by GoodFirms